There’s how much debt you have, and there’s the real cost of debt.

Do you know the real cost of debt? Or, more specifically, do you know what it costs to be in debt? Most people can’t answer this question accurately. You may think you know how much your debt is costing you, but there’s a good chance it’s much more.

I found that debt is not unlike smoking or other habitual actions. When it first starts, you believe you’re in control of it. You can quit at any time. As days and months roll past, the belief doesn’t fade away. With every single debt you incur, the mantra “I can afford it” keeps repeating in your brain. Once reality hits, it’s often too late.

The cost of debt can be direct or indirect. The indirect cost is often more expensive. The direct cost of debt is prominent and most noticeable. When a consumer makes a minimum payment, they see little impact on the principal debt amount. On the other hand, creditors love low or minimum payments as interest equates to profit. In simple interest loans, such as auto loans, there is often a sizable portion of each payment allocated towards interest. Thus, most people do not need any lessons in understanding the direct cost of debt, as they feel it on a monthly basis.

What is more obscure are the indirect costs associated with carrying debt. One of the areas that concern most debtors is the opportunity losses they commonly experience: opportunity losses in an investment, career, financial security, or lifestyle.

Investments

Leveraged investors may have the ability of participating in more investments than a cash investor. A non-leveraged investor can invest in a safer financial instrument. However, leverage investors borrow money at an interest in which the investment must provide a return that exceeds the cost. As the investor knows, there’s a direct correlation between risk and reward; if a higher reward is expected, the associated risk must also be higher. The investor knows some of their investments will lose persuasive value. They must hurdle their investment bets so that their overall financial strategy yields a return to cover the inevitable losses. If the overall strategy doesn’t produce the minimum expected in return, financial lurks in the shadows.

Leverages investors can invest far less volatile areas. The primary reason their money is far less expensive is that they can benefit from lower yields with less risk exposure and netting returns that match their leveraged counterparts.

Careers

As leveraged investors realize higher gains on their investment, consumers in debt must earn higher incomes. Not only to sustain their lifestyle, but also to repay their debt. If the cost of debt is higher, career mobility to consumers will be less. The people are controlled by their financial obligations, not their career interests. They can’t just wake up one day and decide to start a business or take a chance with a different company.

In this sense, debt can become a burden further than financial. Now, the debt is impacting your life decisions, and potential career opportunities. In this situation, we become “stuck” working to pay our debt, rather than working for any form of personal satisfaction.

Financial Security

Financial security is one of the highest costs of debt. People go bankrupt for losing more than everything, not because they lose everything. When people live outside their means, they face the potential of a third party deciding what they will lose. This living act increases the possibility that a bankruptcy judge can order accounts liquidated, assets surrendered, wages garnished, losses that can exceed any perceived gains that were realized by using credit. To reduce the cost of debt, people should be making long-term financial commitments based on short-term stability.

However, the one card to their financial house of cards is the income from a job. Two income households are twice as likely to feel their house of cards shaken. Why? Because they live outside their means. Significant income loss and temporary income loss can quickly destroy their credit and take away items bought with a loan (timeshares, cars, homes). Financial security is one of the costs of debt; debt builds financial insecurity by creating a false sense of financial security.

Lifestyle

Another cost of debt is the lifestyle people are living. They are doing things that exceed their income. Therefore, people in debt tend to work extra. Debtors must maintain a higher level of income to sustain their expenses. They find it difficult to attain some of their dreams like early retirement, taking months off work, owing assets outside their primary home. Thus, people in debt must conform to their lifestyle to meet the limitations that debt presents them.

What is the real cost of debt in black and white?

We talked earlier about the direct impact of debt on consumers. In order to understand why we charge head first into debt, knowing the detrimental impact, we need to understand the psychology of spending. Spending on credit cards is difficult to regulate, with a steady stream of affirmations to yourself that you’ll pay the debt. In reality, this type of spending stems from our inability to say no to ourselves.

A credit card is a false sense of security, meaning that when you hold one or more, you perceive your disposable income to be higher than it actually is. Because of this, your decision making is skewed, and not based on your true ability to take on the debt. This feeling may stick around for a few months, or even a few years. But eventually you will have paid for the actual product several times over, and continue to send payments to cover compounded interest.

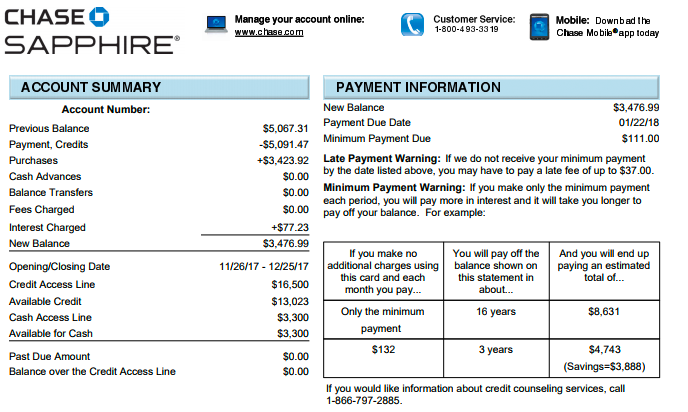

Surprisingly, all credit card statements show you the true cost of debt for that particular debt. Though few people ever see this, or even have the eagle eyesight needed to see it, it’s always there. Here’s an example of what may appear on your credit card statement:

The fine print

This payment information section is found on all credit card statements, though often pretty well hidden. Chase is one of the few that make this information clearly visible. What you’re looking at in this section is your direct cost of debt. In this example, they have a balance of $3,476.99 with a minimum amount due monthly of $111. As Chase shows, if they continue paying $111 a month this debt will take 16 years to pay, and they will have paid a total of $8,631.

This payment information section is found on all credit card statements, though often pretty well hidden. Chase is one of the few that make this information clearly visible. What you’re looking at in this section is your direct cost of debt. In this example, they have a balance of $3,476.99 with a minimum amount due monthly of $111. As Chase shows, if they continue paying $111 a month this debt will take 16 years to pay, and they will have paid a total of $8,631.

This example shows the true cost of debt, and what many of us fail to realize when spending on our credit cards. If you have a credit card statement laying around, take a look at it and find this information. It’s there, though unlike the above example, you usually have to search through the fine print to find it.

If you find yourself in a position where you’re unable to make payments above the minimum on your debt, you likely need help. The good news, you have options. Speak to one of our Certified Debt Counselors today for a free, no-obligation savings analysis to see how we can help make debt history.

Your partner in debt relief,

Consumer First Financial